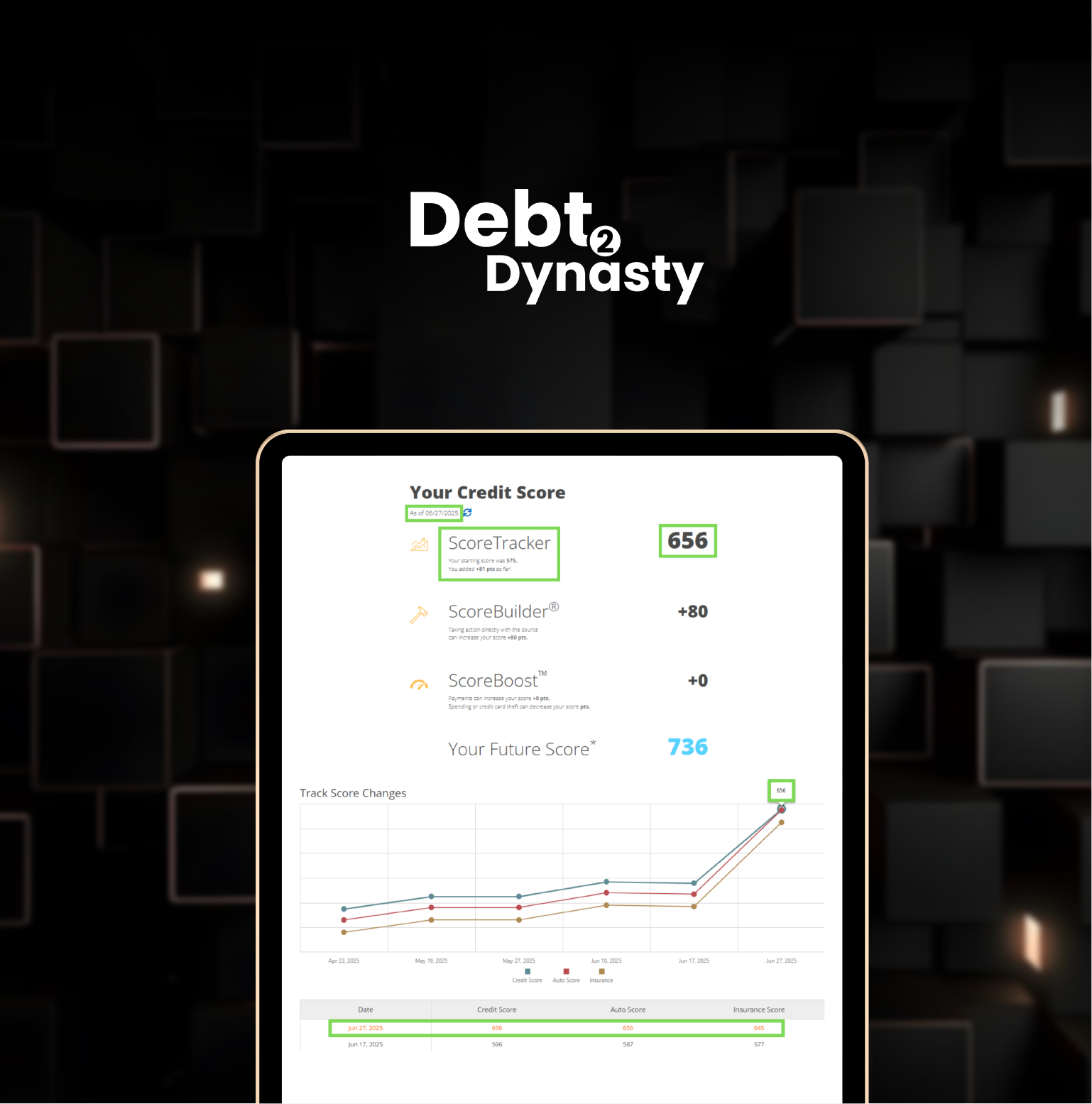

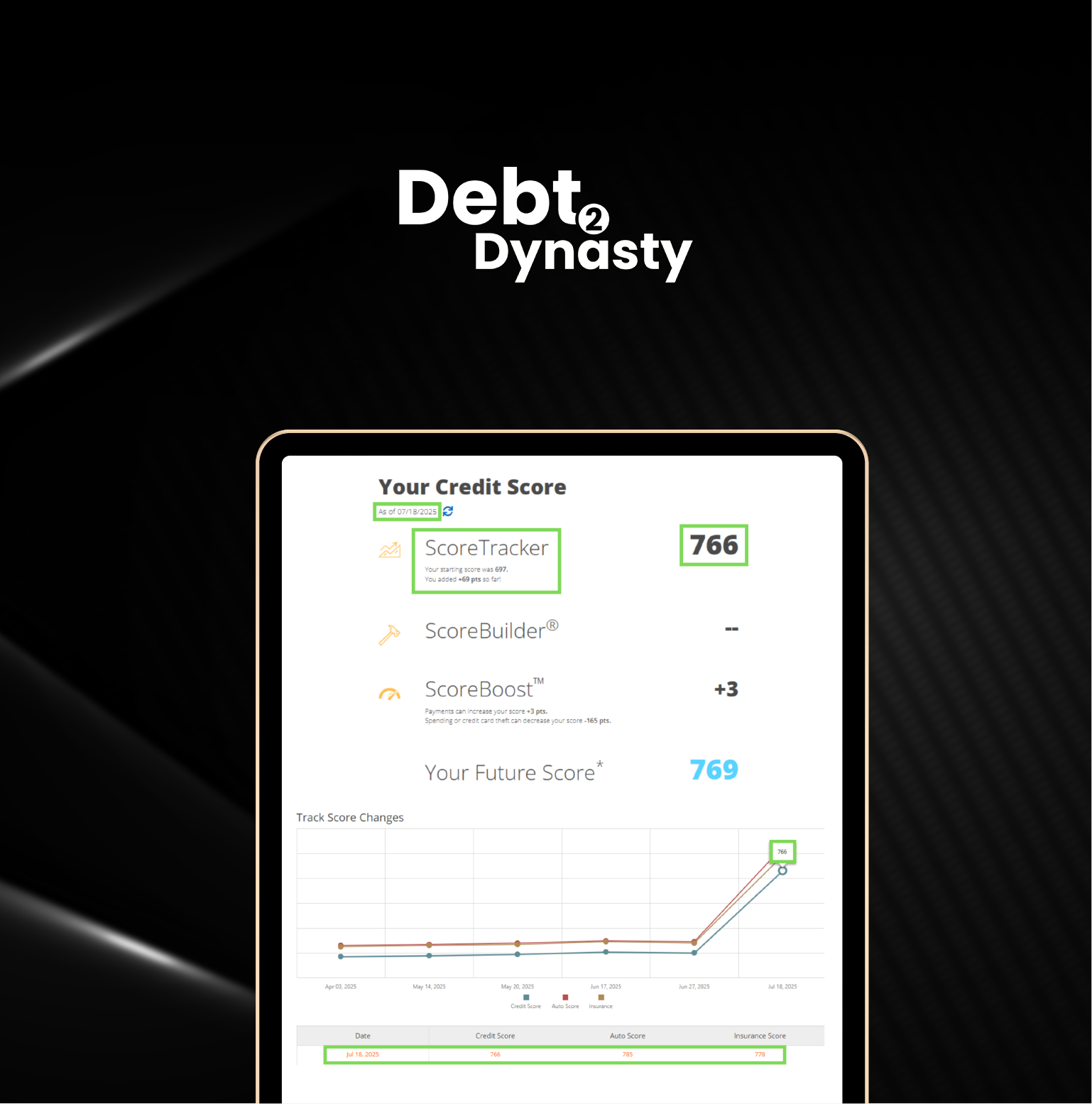

How to Repair Your Credit Fast and Unlock $10K–$100K+ in Funding in as Little as 21 Days

—Without Paying Thousands to a Credit Attorney or Facing Another Bank Rejection

Fix your credit, boost your score, and get approved for the capital you need to build the life and business you’ve been working for.

Meet Max

From Credit Challenges to Business Growth

When Max started out, he had big goals and the drive to achieve them — but his credit was holding him back.

He quickly discovered that in today’s world, opportunities often depend on your credit score. Banks turned him away. Lenders said no. And figuring it out alone was overwhelming.

Instead of giving up, Max learned the system:

Repaired his own credit

Built multiple successful businesses from the ground up

Secured the funding he needed — without relying on friends, family, or luck

Now, Max helps ambitious people do the same:

fix their credit, access the funding they deserve, and create the financial freedom they’ve been working for.

Introducing

The Debt 2 Dynasty Credit Dual Pathway™

One path to repair your credit. One path to unlock the funding you need. Both designed to help you create lasting financial freedom.

You don’t need perfect credit — you need a proven strategy from someone who’s helped countless clients achieve it.

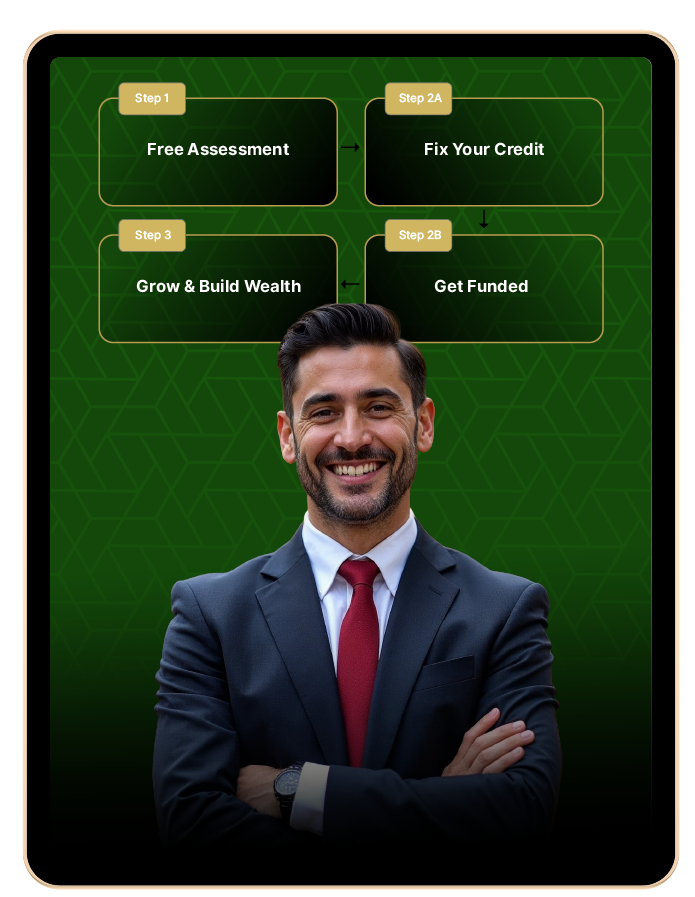

How It Works

Step 1

Free Credit & Funding Assessment

15-minute discovery call

We review your credit, funding readiness, and goals

Step 2A

Credit Pathway

(Fix Your Credit First)

Deep credit report review

Remove negative/inaccurate items

Build a new, positive credit profile

Step 2B

Capital Pathway

(If Funding-Ready)

Business structure audit

Match with real lenders

Secure funding in 7–21 days ($10K–$100K+)

Step 3

Build & Scale

Business credit setup

Long-term funding strategies

Strategic mentorship for growth

How It Works

Step 1

Free Credit & Funding Assessment

15-minute discovery call

We review your credit, funding readiness, and goals

Step 2A

Credit Pathway

(Fix Your Credit First)

Deep credit report review

Remove negative/inaccurate items

Build a new, positive credit profile

Step 2B

Capital Pathway

(If Funding-Ready)

Business structure audit

Match with real lenders

Secure funding in 7–21 days ($10K–$100K+)

Step 3

Build & Scale

Business credit setup

Long-term funding strategies

Strategic mentorship for growth

Choose Your Path:

Credit or Capital

Step 1

Free Assessment

Step 2A

Fix Your Credit

Step 2B

Get Funded

Step 3

Grow & Build Wealth

What You Get

1 on 1 Credit Coaching

Personalized credit report analysis

Unlimited dispute support

Business funding strategy + lender network

Guidance from someone who’s repaired credit and secured funding for hundreds of clients

No upfront fees for funding applications

What makes us different

At Debt 2 Dynasty Credit Repair, we go beyond the basics. While most companies only dispute with the credit bureaus, we take a comprehensive four-angle approach to ensure maximum results.

We dispute directly with:

The Credit Bureaus

The Original Creditors

The Consumer Financial Protection Bureau (CFPB)

The Better Business Bureau (BBB)

This aggressive strategy gives your negative items nowhere to hide.

And if we run into any stubborn accounts? No problem. We have an attorney on our team ready to take legal action on your behalf. If the bureaus fail to comply, we’ll sue and work to get you compensated for each item they refuse to delete.

With Debt 2 Dynasty Credit Repair, you don’t just repair your credit you fight back

Who This Is For (And Not For)

This Is For You If...

You’re an ambitious professional or business owner ready to level up

You've struggled to get funding or build credit

You're serious about building something real

Not For...

People looking for quick money with no work

Anyone unwilling to follow a proven process

Those who expect overnight results without action

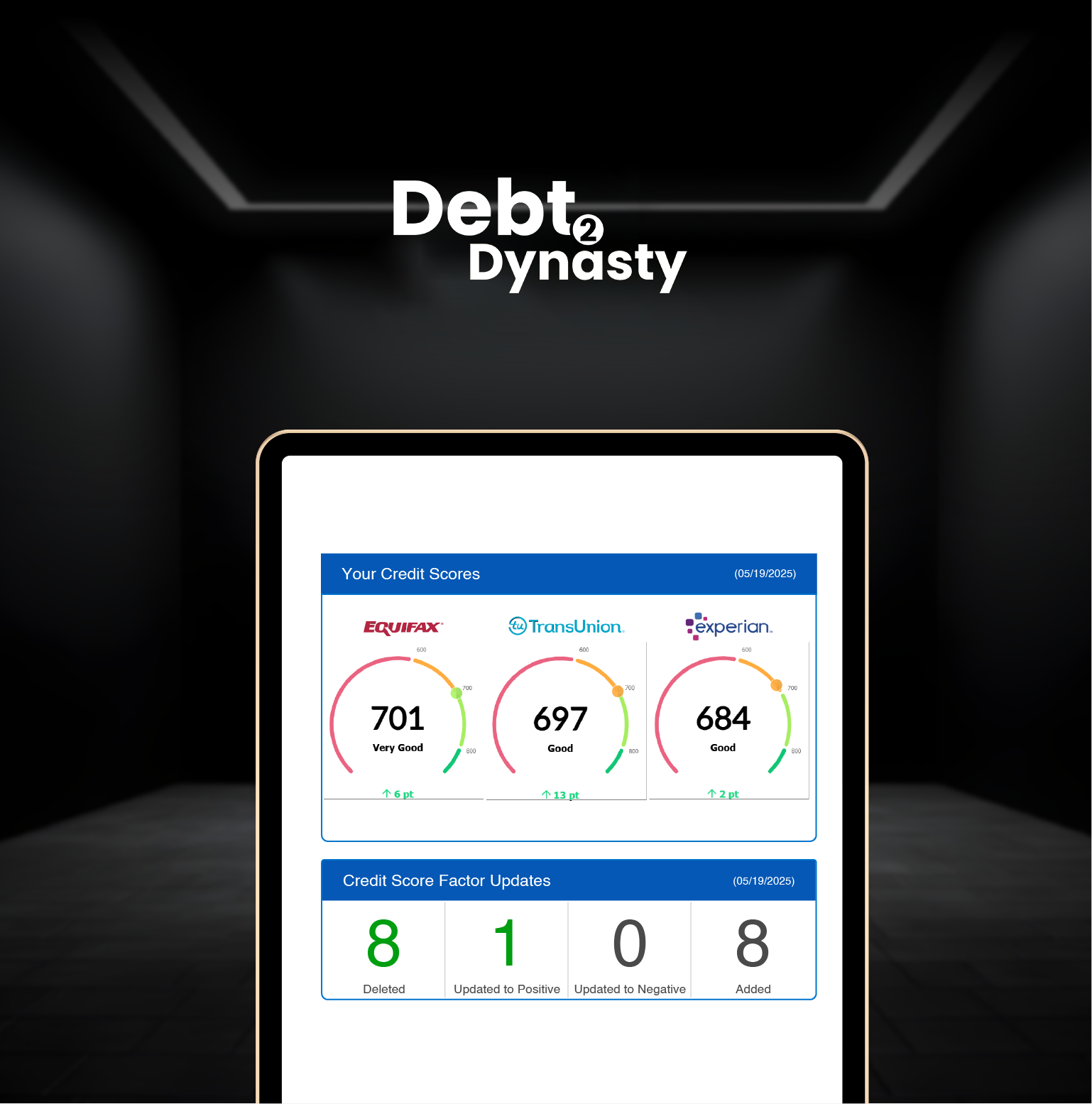

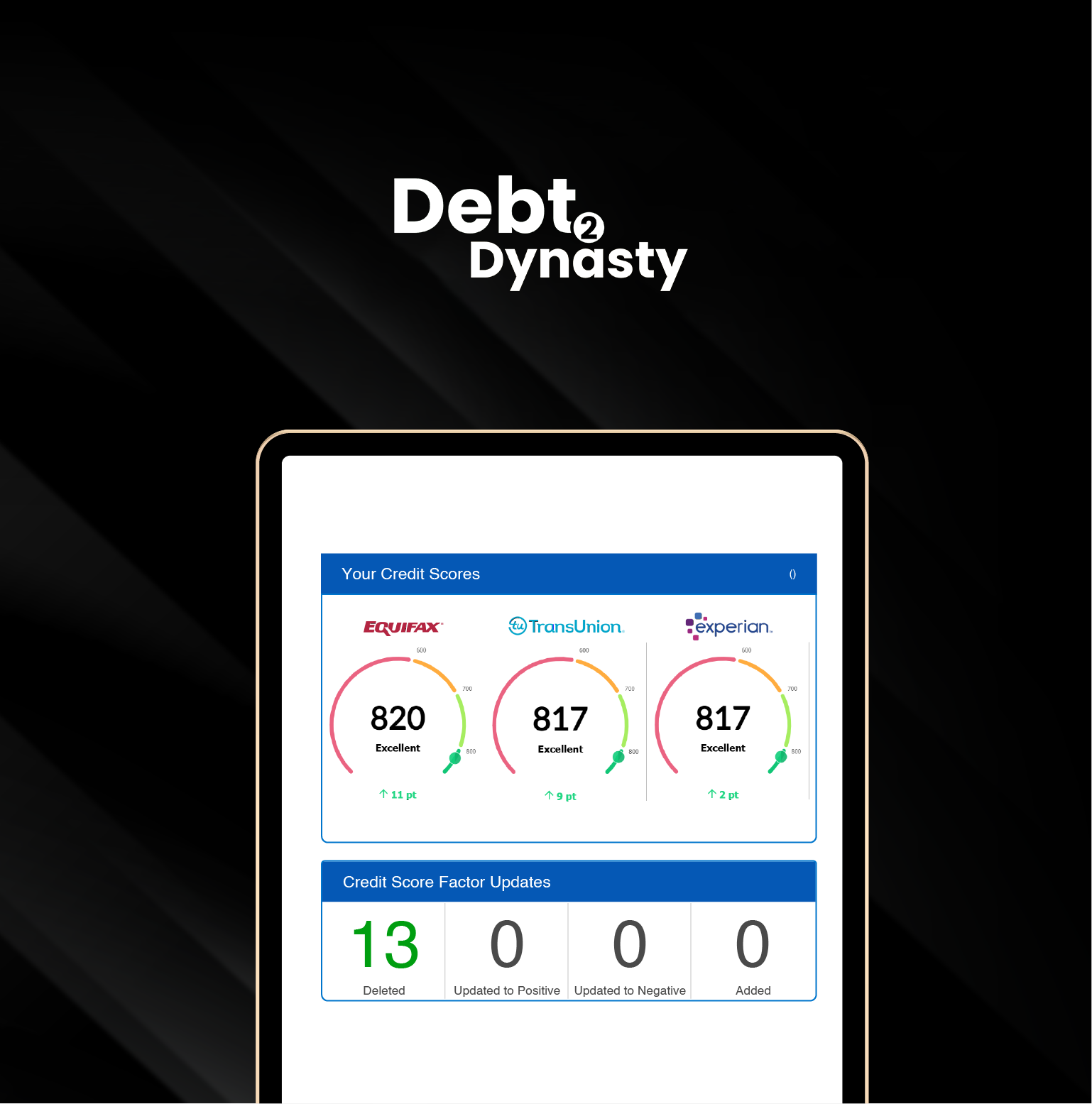

Client testimonial

Frequently Asked Questions

What is expedited credit repair sweep?

Expedited credit repair is a faster approach to improving your credit by using advanced dispute tactics, legal strategies, and direct communication with credit bureaus and creditors to accelerate the removal of inaccurate or negative items from your report — often within 15 to 45 days, rather than the traditional 3 to 6 months.

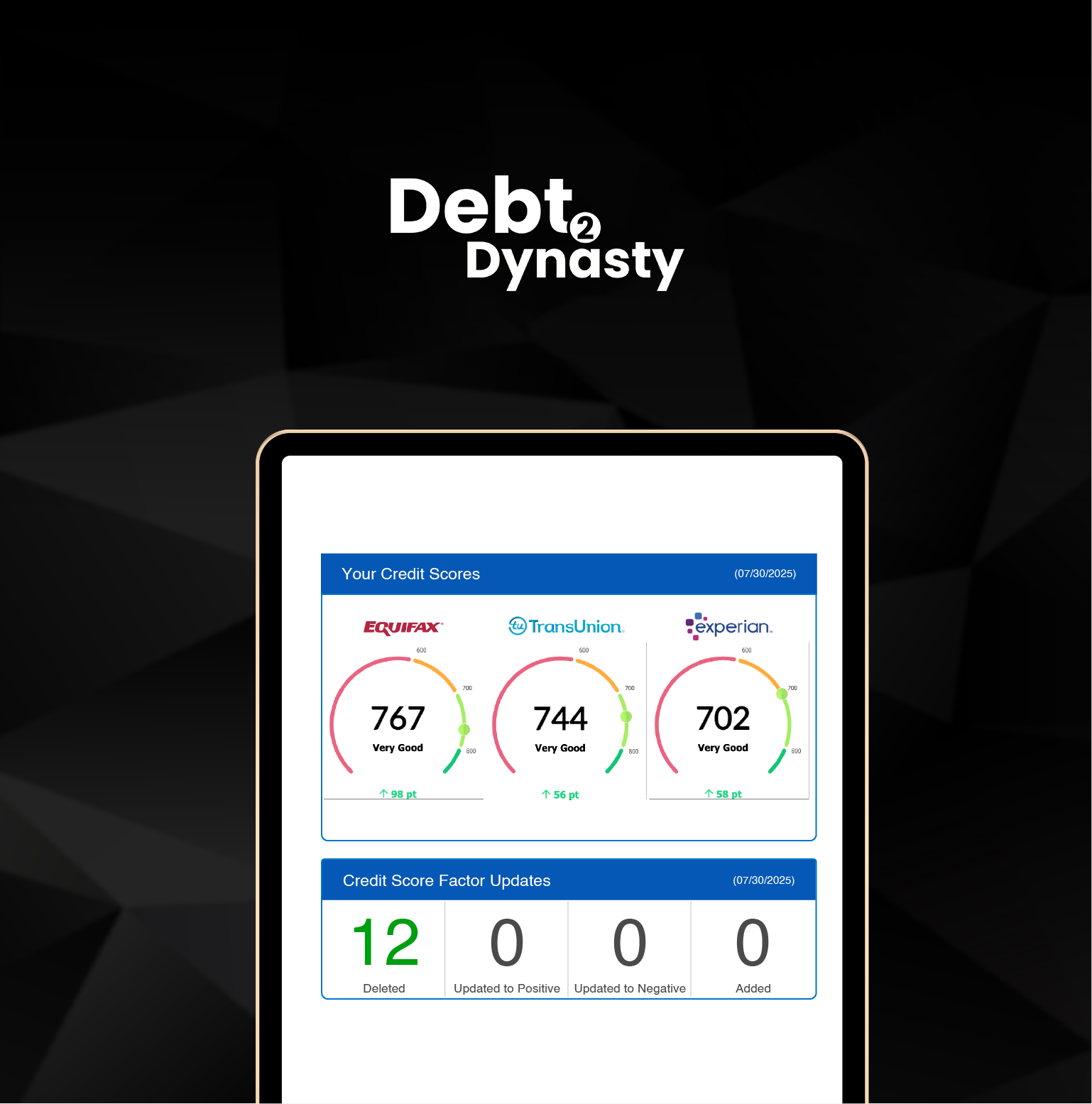

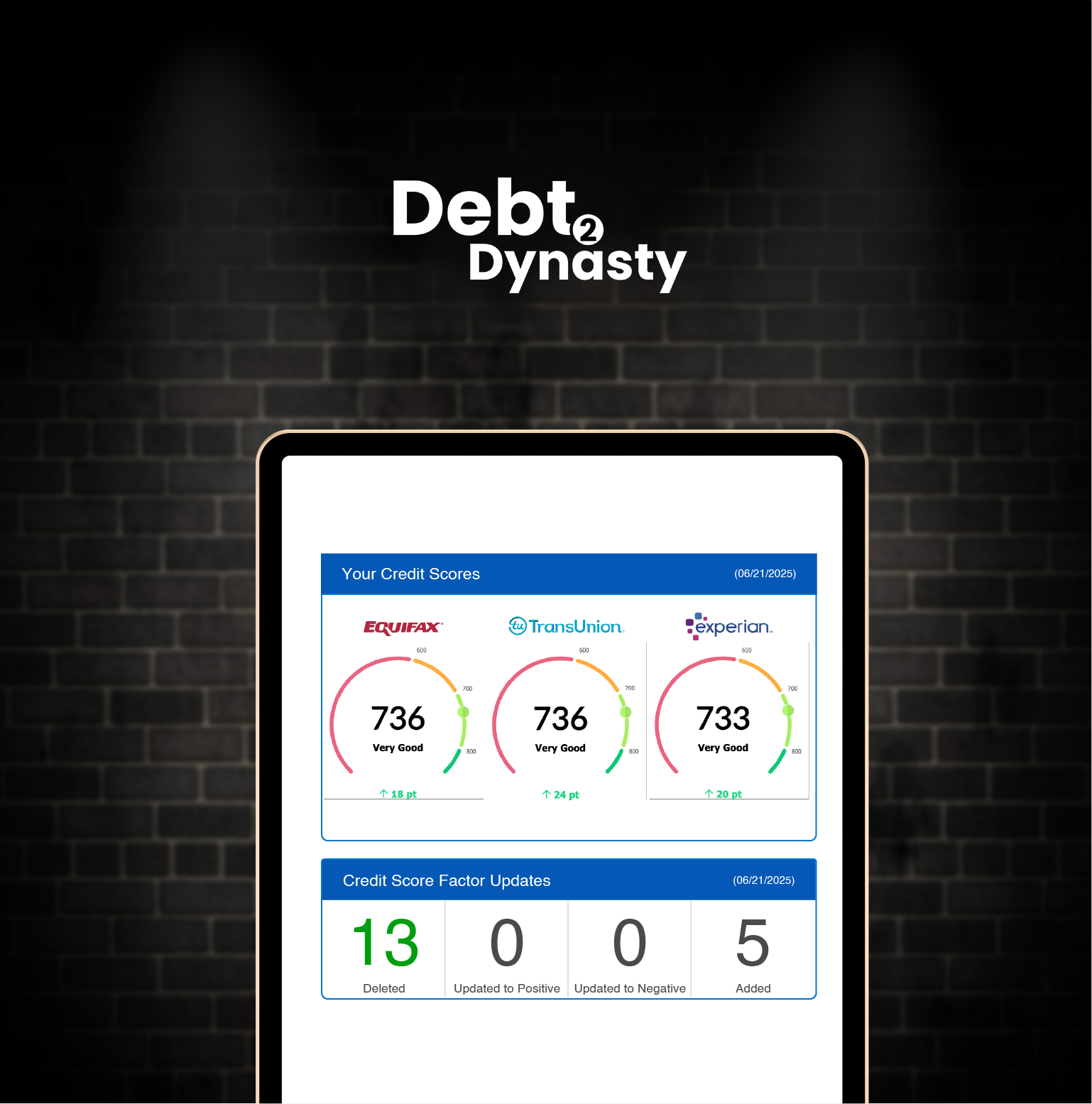

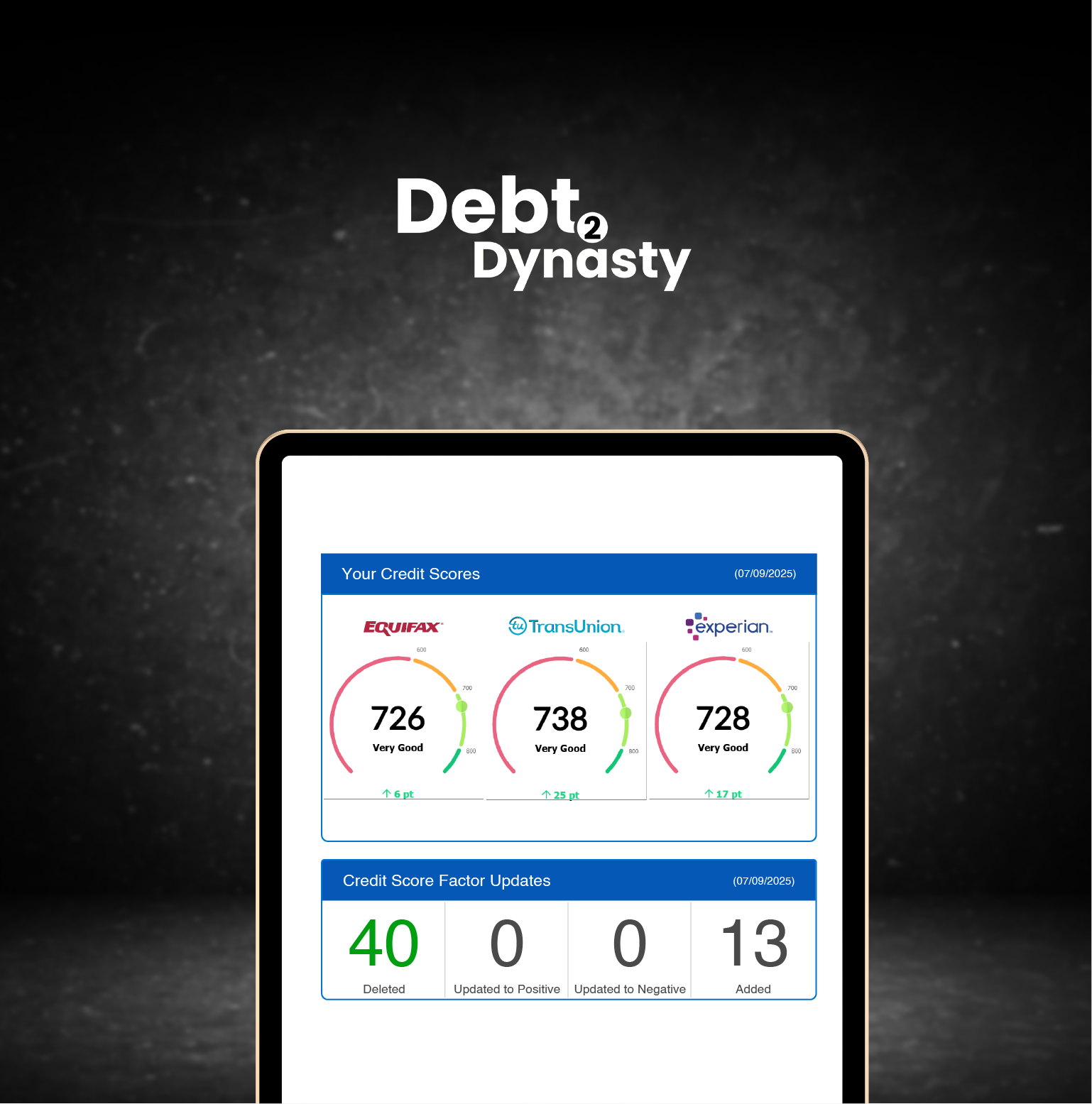

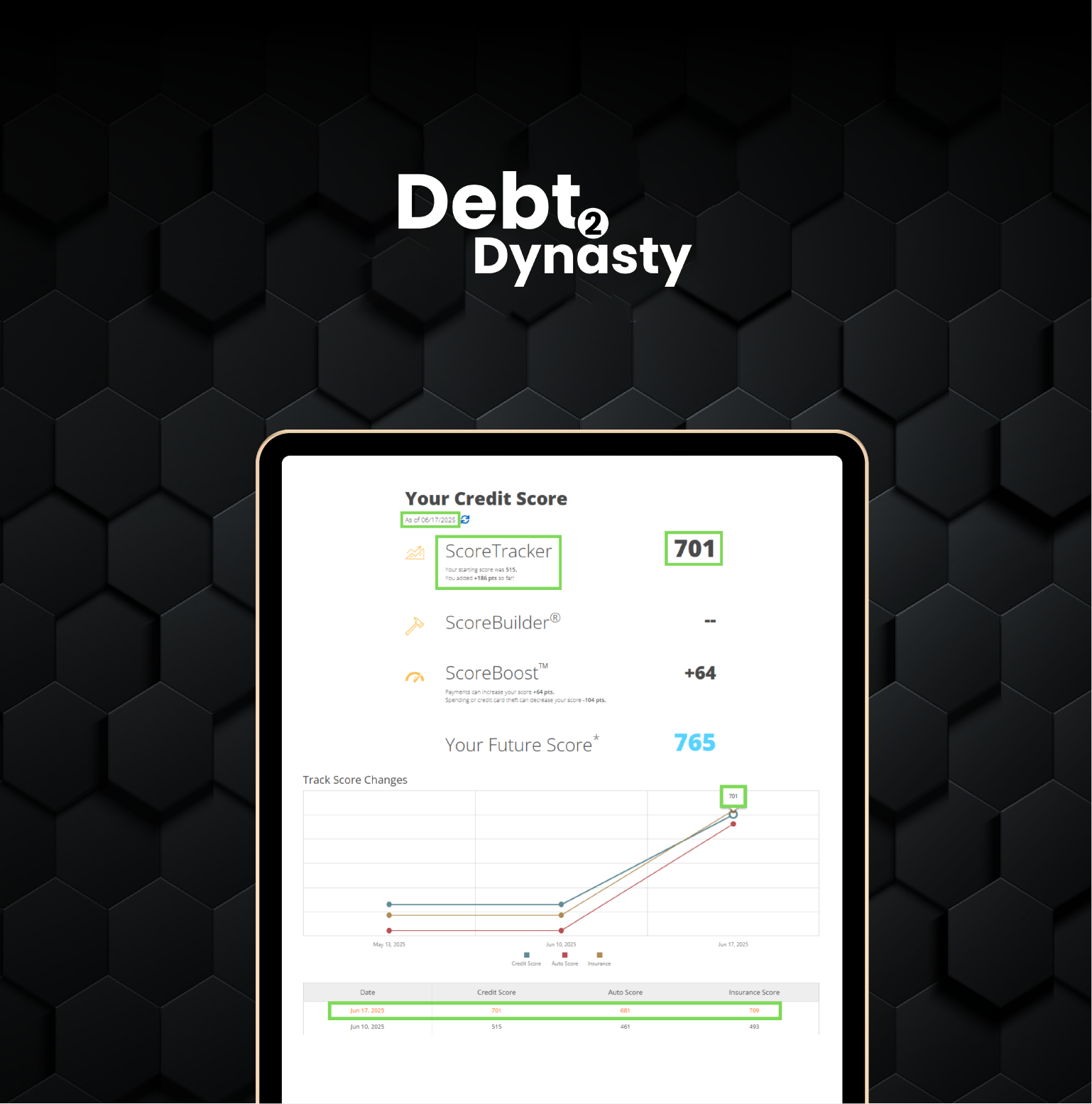

How fast can I see results with your service?

Many clients begin seeing initial results within 7 to 14 business days. While results can vary based on your credit profile, our expedited strategies are designed to get faster outcomes compared to standard credit repair methods.

What types of items can you remove from my credit report?

We can challenge and often remove a wide range of negative items, including:

• Collections

• Late Payments

• Charge-Offs

• Bankruptcies

• Repossessions

• Medical Bills

• Inquiries

• Public Records

Each case is reviewed to determine the best strategy for removal. But literally anything !

How does your expedited process work?

Once you sign up, we immediately pull your credit report, identify harmful accounts, and launch aggressive disputes through credit bureaus, creditors, and third-party agencies like the CFPB. We don’t wait 30–45 days between rounds — we apply continuous pressure for quicker results.

Is expedited credit repair legal?

Yes, credit repair — including expedited methods — is 100% legal under the Fair Credit Reporting Act (FCRA). We simply use your rights as a consumer to demand verification, accuracy, and timely removal of any unverifiable or inaccurate information.

Will your service help me get approved for credit cards, cars, or a home loan?

Absolutely. By increasing your score and cleaning up your report, you’ll improve your chances of being approved for credit cards, auto loans, mortgages, and even business funding. Many of our clients have qualified for major financing within weeks of starting.

Do you offer a money-back guarantee?

Yes. If we don’t remove any negative items from your report or there no score increase within 90 days, you may be eligible for a partial or full refund — depending on your package and compliance with the process. Your satisfaction is our priority.

What do I need to get started?

To get started, you’ll need:

• A valid government-issued ID

• A recent utility bill or proof of address Social security card

• A signed service agreement. Once we have these, we can begin your expedited repair process immediately.

Why We Need Your ID, Proof of Address, and Social Security Card

To legally dispute items on your credit report, we must verify your identity with the credit bureaus. This protects you from fraud and ensures your personal data is handled correctly. The three required documents are:

• Government-issued ID – Confirms your identity.

• Proof of address (like a utility bill) – Verifies where you currently live.

• Social Security card (or W-2/official document with SSN) – Confirms your Social Security number to match your credit profile.

These documents are required by law and help us file effective disputes on your behalf, ensuring faster and more accurate results.

Will this affect my ability to get new credit while working with you?

Not at all. In fact, cleaning your report and boosting your score may improve your approval odds. We’ll also guide you on which positive tradelines or credit tools to add to further improve your profile.

What Happens If the Credit Bureaus Don’t Cooperate?

We don’t just dispute — we fight back.

If we run into any stubborn or unresponsive accounts, you’re still in a win-win situation. That’s because we have a licensed attorney on our team who will legally pursue the credit bureaus, data furnishers, or creditors if they fail to comply with federal credit laws like the Fair Credit Reporting Act (FCRA).

Here’s how it works:

• If a negative item is inaccurate and the bureaus refuse to delete it,

• Our attorney will file a lawsuit on your behalf,

• And if we win (which we often do), you may receive compensation for each violation — and the negative item still gets removed.

☑️ You win if they delete it — your score improves.

☑️ You win if they don’t — we sue, get it deleted, and you get paid.

No other credit repair company brings this level of accountability and protection. That’s why our clients don’t just see results — they see justice.

Fix Your Credit, Unlock Funding, and Build the Future You’ve Been Working For

Copyrights 2025 | Debt 2 Dynasty LLC™ | Terms & Conditions